IN THIS EDITION |

||

|

||

|

||

A host of economic data released over the last month, typically with a lag of 2-6 weeks, provides some closure to FY2017 and offers clues regarding what lies in store for the new fiscal.

A host of economic data released over the last month, typically with a lag of 2-6 weeks, provides some closure to FY2017 and offers clues regarding what lies in store for the new fiscal.

Several volume-based indicators tracked by ICRA, spanning mining, electricity, manufacturing, trade, transport and financing, recorded a YoY improvement in growth in March 2017, relative to the previous month, in the most broad-based uptick since the note ban.

Core sector growth improved to 5.0% in March 2017 from 1.0% in February 2017, with a double-digit growth of coal and steel output. In contrast, cement volumes continued to contract by 6.8% in March 2017, signalling that construction activities are yet to fully recover from the note ban.

Auto production registered an expansion across passenger vehicles, commercial vehicles and two-wheelers in March 2017, as well as a sequential improvement relative to the growth performance in February 2017.Both merchandise imports and exports posted multi-year high expansions of 45.3% and 27.6%, respectively, in US$ terms for March 2017, partly reflecting higher commodity prices.

Within the transport and logistics sectors, the pace of YoY expansion of rail freight, consumption of diesel and of ATF improved in March 2017, relative to the previous month, although growth in petrol consumption and passenger traffic by domestic airlines displayed moderation.

In terms of financing, commercial paper outstanding recorded a sharp YoY growth of 52.9% on March 31, 2017, up from the paltry 4.7% at the end of the previous month. Moreover, the YoY growth of non- food credit improved slightly to 5.8% on March 31, 2017 from 4.8% on March 3, 2017. However, bank deposit growth eased to 11.8% from 12.7%, respectively, as remonetisation dampened the seasonal surge in deposit accretion.

The question persists whether this pickup in volume growth will sustain, going into FY2018. The uptick in March 2017 can partly be attributed to the recovery engendered by remonetisation, which is likely to prove relatively sustainable. However, an attempt to meet year-end targets may have resulted in channel stuffing in some sectors in March 2017, given the somewhat weak performance in January-February 2017. Such sectors may record a slide in growth in Q1 FY2018.

Additionally, with the goods and services tax (GST) to be implemented from July 1, 2017, ICRA expects industry to pare inventory levels during the transition, mildly dampening production in Q1 FY2018. Moreover, Q2 FY2018 and Q3 FY2018 are likely to witness temporary disruption, as the assessees get used to the new compliance procedures. The positive impact of the GST on economic activity is likely to be visible from Q4 FY2018 onwards.

A normal monsoon, likely rise in minimum support prices for various crops and automatic stabilisers such as the rural employment guarantee scheme, would support rural consumption. Urban consumption would benefit from pay revision for state government employees and pensioners, which should bolster volume growth. A rise in capacity utilization to healthier levels would set the stage for a revival of private sector investments.

However, the tone of the minutes of the Monetary Policy Committee’s April 2017 meeting was rather hawkish. After a prolonged pause, we expect the next rate action to be a hike, which could lead to a firmer cost of funding by the end of this fiscal.

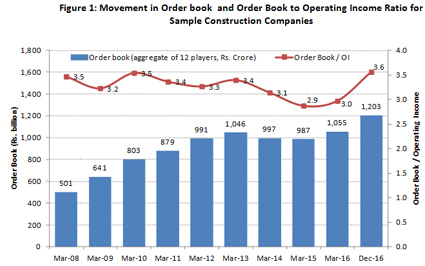

The construction sector is showing signs of recovery supported by improvement in key infrastructure segments like roads and urban infrastructure. The road sector in particular has been a major contributor both in terms of new order inflows and improvement in the pace of execution. While the construction gross value added (GVA) growth still remains modest with 2.6% Y-o-Y growth during 9m-FY2017, many construction companies have shown stronger growth in operating income during the same period, supported by large order books as well as improved pace of execution. A major push from the Government on roads, railways, and urban infrastructure segments has helped construction companies improve their order book position. The pipeline of new order inflows also remains healthy with the Budget 2017-18 continuing its thrust on the infrastructure sector. Further, Government has granted ‘infrastructure’ status to affordable housing projects which will increase new projects in this segment and augment order book for companies engaged in residential construction segment.

The construction sector is showing signs of recovery supported by improvement in key infrastructure segments like roads and urban infrastructure. The road sector in particular has been a major contributor both in terms of new order inflows and improvement in the pace of execution. While the construction gross value added (GVA) growth still remains modest with 2.6% Y-o-Y growth during 9m-FY2017, many construction companies have shown stronger growth in operating income during the same period, supported by large order books as well as improved pace of execution. A major push from the Government on roads, railways, and urban infrastructure segments has helped construction companies improve their order book position. The pipeline of new order inflows also remains healthy with the Budget 2017-18 continuing its thrust on the infrastructure sector. Further, Government has granted ‘infrastructure’ status to affordable housing projects which will increase new projects in this segment and augment order book for companies engaged in residential construction segment.

Government has taken several measures to revive the sector; one such major decision was taken by the Cabinet Committee on Economic Affairs (CCEA) in Sep-2016 to release 75% of pending claims of developers/contractors with the Government authorities, which have been awarded by the arbitration tribunal. This is expected to improve liquidity of the players involved which in turn would help in reducing the leverage and subsequently improve project execution thereby helping them to come out of the vicious debt cycle. However, the progress thus far has been rather slow with only Rs. 933 crore released till Apr-2017 out of total claims of over Rs. 3,000 crore which have been filed for this liquidity relief.

Government has taken several measures to revive the sector; one such major decision was taken by the Cabinet Committee on Economic Affairs (CCEA) in Sep-2016 to release 75% of pending claims of developers/contractors with the Government authorities, which have been awarded by the arbitration tribunal. This is expected to improve liquidity of the players involved which in turn would help in reducing the leverage and subsequently improve project execution thereby helping them to come out of the vicious debt cycle. However, the progress thus far has been rather slow with only Rs. 933 crore released till Apr-2017 out of total claims of over Rs. 3,000 crore which have been filed for this liquidity relief.

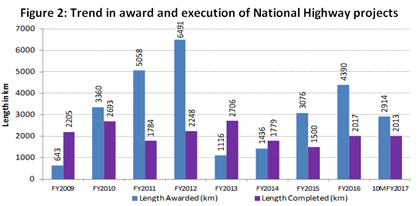

The pace of execution for highway projects of NHAI increased by 29% during 10M-FY2017, to 6.58 kms/day from 5.11 kms/day, during 10M-FY2016. During 10M-FY2017, 50 projects totalling 2914 kms were awarded (against 3197 kms during 10M FY2016); of these, almost half were awarded through the Hybrid Annuity Mode (HAM).

The pace of execution for highway projects of NHAI increased by 29% during 10M-FY2017, to 6.58 kms/day from 5.11 kms/day, during 10M-FY2016. During 10M-FY2017, 50 projects totalling 2914 kms were awarded (against 3197 kms during 10M FY2016); of these, almost half were awarded through the Hybrid Annuity Mode (HAM).

Asset sales in the road sector have also picked up over the last 24 months with the relaxation in exit policy. Sponsors in around 20 road assets involving a total cost of Rs.123.27 billion have monetised their assets as opposed to around Rs.70 billion in the preceding 50 months. Decline in interest rates, and healthy outlook on toll collection growth has helped in improving valuations of toll road projects.

Road sector has seen good number of asset sales over the last two years, reflecting investors’ interest in the sector as well as developers willingness to divest their BOT assets to release capital for improving balance sheet and undertaking fresh investment. Recently, IRB Infrastructure came out with India’s first Infrastructure Investment Trust (InvIT) and received good response from the Investors. This will pave the way for other infrastructure developers to unlock capital through this route.”

The CV industry witnessed a demand slowdown in FY 2017 on the back of waning replacement-led demand, weak cargo availability from industrial sectors and uncertainty related to effective taxation on the industry

under the GST regime. It was expected that the industry would witness a pre-buying demand in the last quarter given the transition to new emission norms (i.e. Bharat Stage-IV) from April 2017 and vehicles complying with new emission norms were expected to become 6-10% more expensive because of technology upgradation. Despite industry volumes recovering in Jan-Mar 2017, the revival has been below earlier expectations. ICRA believes that fleet operators have deferred fleet expansion/ renewal plans given the subdued economic activity along with the likelihood of GST implementation in the near-term.

The CV industry witnessed a demand slowdown in FY 2017 on the back of waning replacement-led demand, weak cargo availability from industrial sectors and uncertainty related to effective taxation on the industry

under the GST regime. It was expected that the industry would witness a pre-buying demand in the last quarter given the transition to new emission norms (i.e. Bharat Stage-IV) from April 2017 and vehicles complying with new emission norms were expected to become 6-10% more expensive because of technology upgradation. Despite industry volumes recovering in Jan-Mar 2017, the revival has been below earlier expectations. ICRA believes that fleet operators have deferred fleet expansion/ renewal plans given the subdued economic activity along with the likelihood of GST implementation in the near-term.

As a result of pre-buying (although lower than expected), CV demand would be relatively subdued in early part of the FY 2018. While fleet operators are likely to defer incremental investments, OEMs would look to align their production and inventory levels to the new GST regime.

Within the CV industry, the M&HCV (Truck) segment is likely to register a growth of 6-8% in FY 2018, due to higher budgetary allocation towards infrastructure and rural sectors, potential implementation of vehicle scrap program and stricter implementation of regulatory norms especially related to vehicle length (for certain applications) and overloading norms. Furthermore the National Green Tribunal’s (NGT's) thrust on phasing out old diesel vehicles along with Government's proposed vehicle modernization program would trigger replacement-led demand. Also resumption of mining activities in select states would continue to support demand for the Tipper segment.

As for the LCVs (Truck), post three years of declining sales, the segment is on a structural uptrend and would recover swiftly once the liquidity situation improves. In the near-term, replacement-led demand and expectation of stronger demand from consumption-driven sectors and E-commerce logistic companies would remain key growth drivers. Over the medium-term, LCVs would benefit from GST roll-out and its impact on logistics sector; and preference for hub-n-spoke model. ICRA expects LCV’s to register a growth of 11-13% over the medium-term.

The domestic bus segment may grow by 5-7% in FY 2018 in unit terms aided by stable demand from SRTU segment (backed GOI’s focus on improving urban as well as rural transportation and focus towards smart cities initiatives). Over the past few years, bus volumes has benefitted from healthy demand from online aggregators, staff carriers segment and Schools & College segment, a stable source of bus market in India. ICRA believes higher replacement-led demand given the reducing fleet replacement cycle with rising customer expectations for comfortable journey will boost demand.

Factors like slowdown in the M&HCV truck sales, increased discounts and only a partial recovery of increased steel prices and other overheads, led to the aggregate OPBDIT margins of CV OEMs (five leading players) shrinking by 160 bps to 5.9% in 9m FY 2017 compared to corresponding period in the previous year. On a sequential basis too, margins contracted by 200 bps from 6.0% in Q2 FY 2017 to 4.0% in Q3 FY 2017.

Due to subdued sales in Q1/H1 FY 2018, competitive pressures and rising input material costs, CV OEM’s margins are expected to remain under pressure in FY 2018. Furthermore, OEMs may not be able to completely pass on the cost related to BS-IV technology upgradation owing to relatively subdued demand. Over the medium-term, profitability may be impacted by intensified competition (as foreign OEMs scale-up volumes on back of new model launches and expanding sales network) and higher investments in developing new models and technologies (to meet next level of emission norms).

Despite pressure on profitability, credit profile of CV OEMs will be stable in the near to medium term. As industry’s capacity utilization remains around 50-55%, most OEMs will limit Greenfield investments over the next 2-3 years. This would limit overall investments to new product development, addressing portfolio gaps and technology upgradation related to next level of emission norms. Some OEMs are eyeing growing international business and are also contemplating setting-up overseas assembly units. ICRA estimates the CV OEMs will spend approximately Rs. 31-33 billion p.a. (on aggregate basis) over the medium-term in the aforementioned areas.

Increasing levels of gross non-performing assets in Indian Banks is a matter of great concern as it has adversely impacted the profitability, capitalisation and solvency levels of Indian banks, especially during the last two financial years. Though the fresh non-performing asset (NPA) generation rate showed signs of moderation with the annualised fresh NPA generation declining to 4.1% during Q3 FY2017 as compared with 5.8% during Q2 FY2017, the large quantum of fresh slippages outside the standard restructured advances suggests further asset quality pain .Accordingly, the outlook on the asset quality of the Indian banking sector remains weak and will continue to increase the pressure on internal capital generation and higher capital requirements under the Basel III capital adequacy framework. We estimate that the capital requirement for public sector banks at Rs. 1.25-1.35 trillion for the next two years of which Rs. 800-850 billion has to be by way of core equity capital.

Increasing levels of gross non-performing assets in Indian Banks is a matter of great concern as it has adversely impacted the profitability, capitalisation and solvency levels of Indian banks, especially during the last two financial years. Though the fresh non-performing asset (NPA) generation rate showed signs of moderation with the annualised fresh NPA generation declining to 4.1% during Q3 FY2017 as compared with 5.8% during Q2 FY2017, the large quantum of fresh slippages outside the standard restructured advances suggests further asset quality pain .Accordingly, the outlook on the asset quality of the Indian banking sector remains weak and will continue to increase the pressure on internal capital generation and higher capital requirements under the Basel III capital adequacy framework. We estimate that the capital requirement for public sector banks at Rs. 1.25-1.35 trillion for the next two years of which Rs. 800-850 billion has to be by way of core equity capital.

Last month, the RBI tightened the norms for Prompt Corrective Action (PCA) for banks. Based on the revised PCA framework, a total of 16 PSBs out of 21 (excluding SBI associates) and two out of 16 private banks would need to initiate mandatory corrective actions such as raising capital levels, restricting the dividend payments, branch expansions or face restrictions on management compensation to come out of the PCA framework. Though the number of banks under the PCA will increase following the revised guidelines, we expect these measures will strengthen the banking system over the medium term. It will allow the stronger and well managed banks to grow while putting the onus of improving the systems and procedures will be more on the weaker banks and their promoters/management.

Concerned on the enormity of the issue, the Government of India (GoI) issued an ordinance in May 2017 to amend the Banking Regulation Act, 1949, whereby it can issue order to RBI to issue directions to any bank to initiate the insolvency resolution process under the provisions of Insolvency and bankruptcy code 2016, against defaulting entities. The ordinance also empowers RBI to appoint members in the committees constituted for resolution of stressed assets. We believe that Initiation of proceedings under the bankruptcy code may force borrowers and lenders to come on a common platform and accelerate the resolution, given the limited timeframe of 180 days (with provision of one time extension of 90 days) under the bankruptcy code, else face a liquidation process.

While the actions of the GoI are steps in the right direction, however ability to the banks, borrowers and creditors to agree on the fresh funds that the borrowers are willing to infuse or the haircuts that the lenders and creditors agree to take on their exposures will be critical to the resolution of the accounts.

For any queries related to this issue of ICRA Insight, get in touch with

Ms. Naznin Prodhani naznin.prodhani@icraindia.com

or +91 124 4545860/ 9594929632

Follow us on ICRA

HelpDesk +91-124-3341580

© 2017 ICRA Limited. All Rights Reserved ICRA INSIGHT DOES NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, NOR DOES IT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. ICRA INSIGHT DOES NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. ICRA INSIGHT IS ISSUED WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT ICRA’S PRIOR WRITTEN CONSENT. To the extent permitted by law, ICRA and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability: I. to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH INFORMATION IS GIVEN OR MADE BY ICRA IN ANY FORM OR MANNER WHATSOEVER. |

In this edition of ICRA Insight, we discuss the economic data that has been released over the last one month, many of which points towards a more broad-based recovery across sectors than has been the case earlier. This includes several volume-based indicators tracked by ICRA, including mining, electricity, manufacturing, trade and transport. While the positive trends are likely to be sustained, there are still question marks over revival in private sector investments, as well as the likely impact of the implementation of GST on economic growth.

In this edition of ICRA Insight, we discuss the economic data that has been released over the last one month, many of which points towards a more broad-based recovery across sectors than has been the case earlier. This includes several volume-based indicators tracked by ICRA, including mining, electricity, manufacturing, trade and transport. While the positive trends are likely to be sustained, there are still question marks over revival in private sector investments, as well as the likely impact of the implementation of GST on economic growth.